Puerto Rico’s governor signed a bill Monday to overhaul the U.S. territory’s tax laws in a bid to attract foreign investment and help workers and some business owners amid a 12-year recession.

The bill creates an earned income tax credit, reduces a sales tax on prepared food and eliminates a business-to-business tax for small to medium companies, among other things.

Officials say the bill represents nearly $2 billion in tax relief at a time when the island is struggling to recover from Hurricane Maria and restructure a portion of its more than $70 billion public debt load.

«There’s still a lot of work to be done to completely transform the tax system … but we see it as a good first step,» said Cecilia Colon, president of Puerto Rico’s Association of Public Accountants.

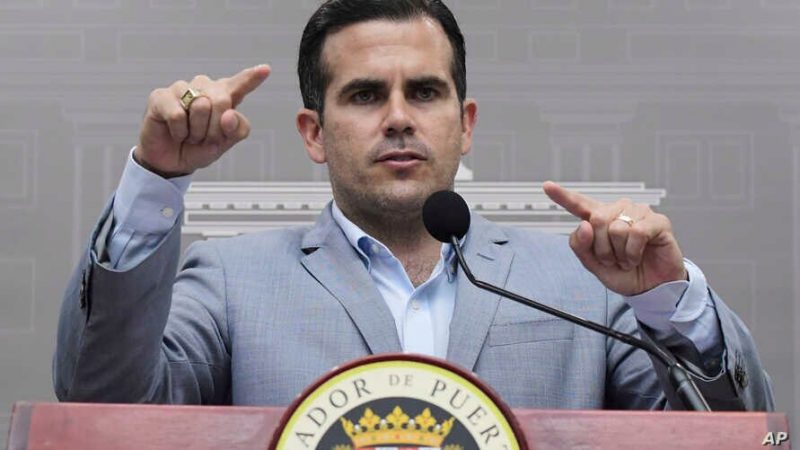

Governor Ricardo Rossello said the earned income tax credit will result in benefits ranging from $300 to $2,000 for each worker, representing a total of $200 million in annual savings. He also said an 11.5 percent sales tax on processed food will drop to 7 percent starting in October 2019.

Link: https://www.voanews.com/usa/puerto-rico-overhauls-tax-laws-help-workers-businesses